2025 Job Market and Stock Market Reviews

The job market hit the brakes in 2025 because companies hired more cautiously, earlier job gains were overstated, and previous openings dried up.

In spite of a tough employment landscape, 2025 rewarded patient investors—stocks climbed, bonds bounced back, and international markets shone bright.

… this seeming dichotomy once again proving that staying invested beats trying to outsmart the headlines.

Why did the job market cool considerably in 2025?

The latest report by the Bureau of Labor Statistics confirms that the job market cooled significantly in 2025, with much slower job growth, rising unemployment, and several months of actual job losses for the first time since 2020. That said, it's important to maintain perspective since many other parts of the economy have been beating expectations.

Here are some key factors to consider:

• Job creation slowed dramatically in 2025, with only 584,000 jobs added for the year compared to 2.0 million in 2024. There were three months of negative job growth, the most since 2020. This means that the average job growth per month was only 49,000, far lower than the average of 168,000 in 2024. Because there was a significant negative revision to October (173,000 jobs lost), the monthly average over the fourth quarter of 2025 was a loss of 22,000 jobs.

• The unemployment rate finished the year at 4.4%, but rose as high as 4.5% in November. While this was its highest level in over four years, it is still low by historical standards. Some data was delayed or unavailable due to the government shutdown in October and early November.

• The BLS revises these data each year, and the latest figures suggest there will be a major revision of 911,000 fewer jobs from the period of March 2024 to March 2025. This means the job gains were overstated over this period when they were initially reported.

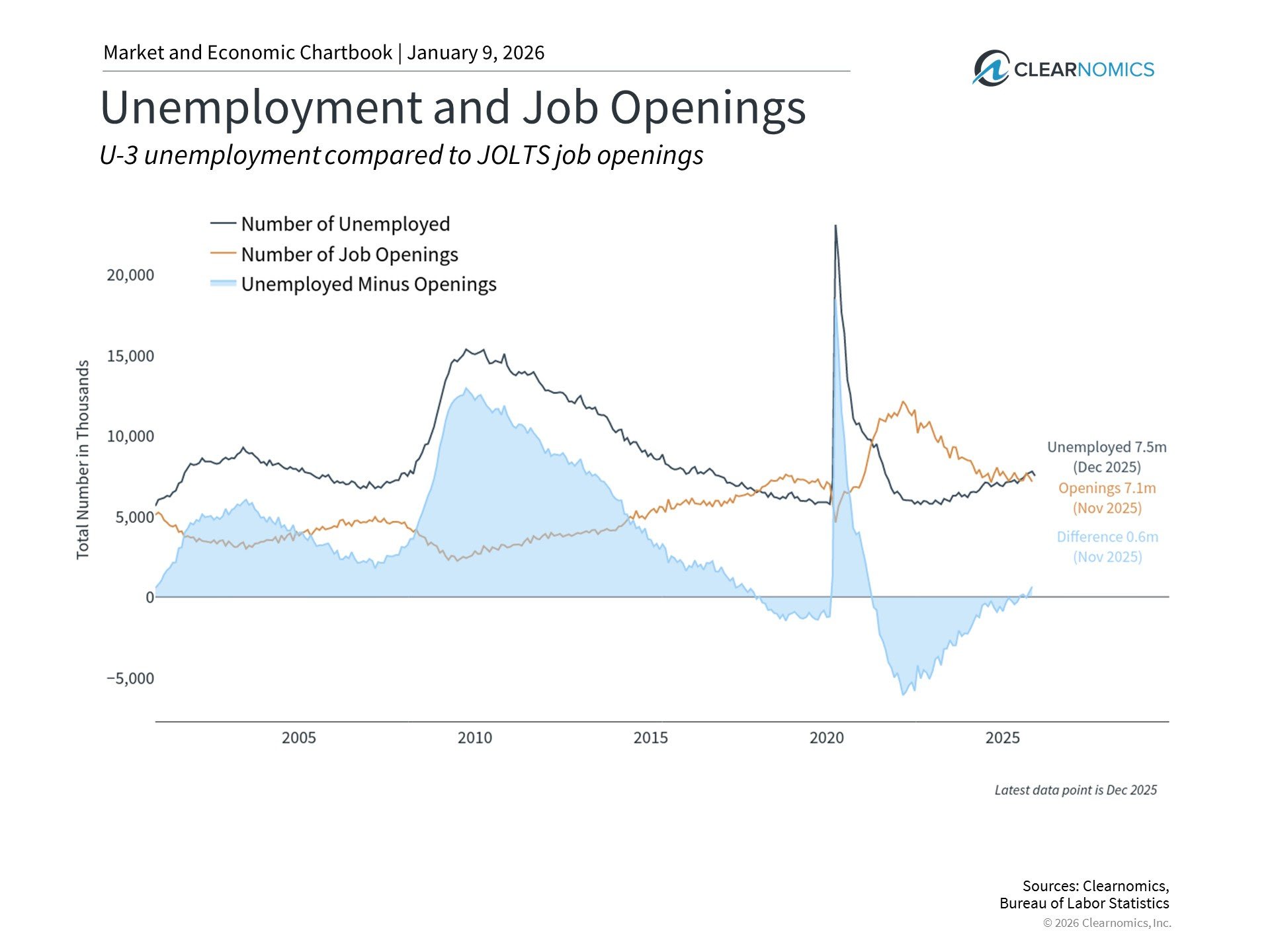

• A separate report showed that job openings have declined to 7.1 million. This means that there are now fewer job openings than unemployed people, a reversal of the trend of the last several years. This suggests that companies may be hiring less due to economic uncertainty.

The included chart below shows recent trends in unemployment and job openings, illustrating how job growth has slowed over time. This matters because employment is a key driver of consumer spending and economic growth, so weakening job creation can signal broader economic challenges.

While a cooling job market creates near-term uncertainty, long-term investors should remember that economic cycles are normal, and markets have historically recovered from periods of weakness by focusing on fundamental growth drivers over time.

How did markets perform in 2025?

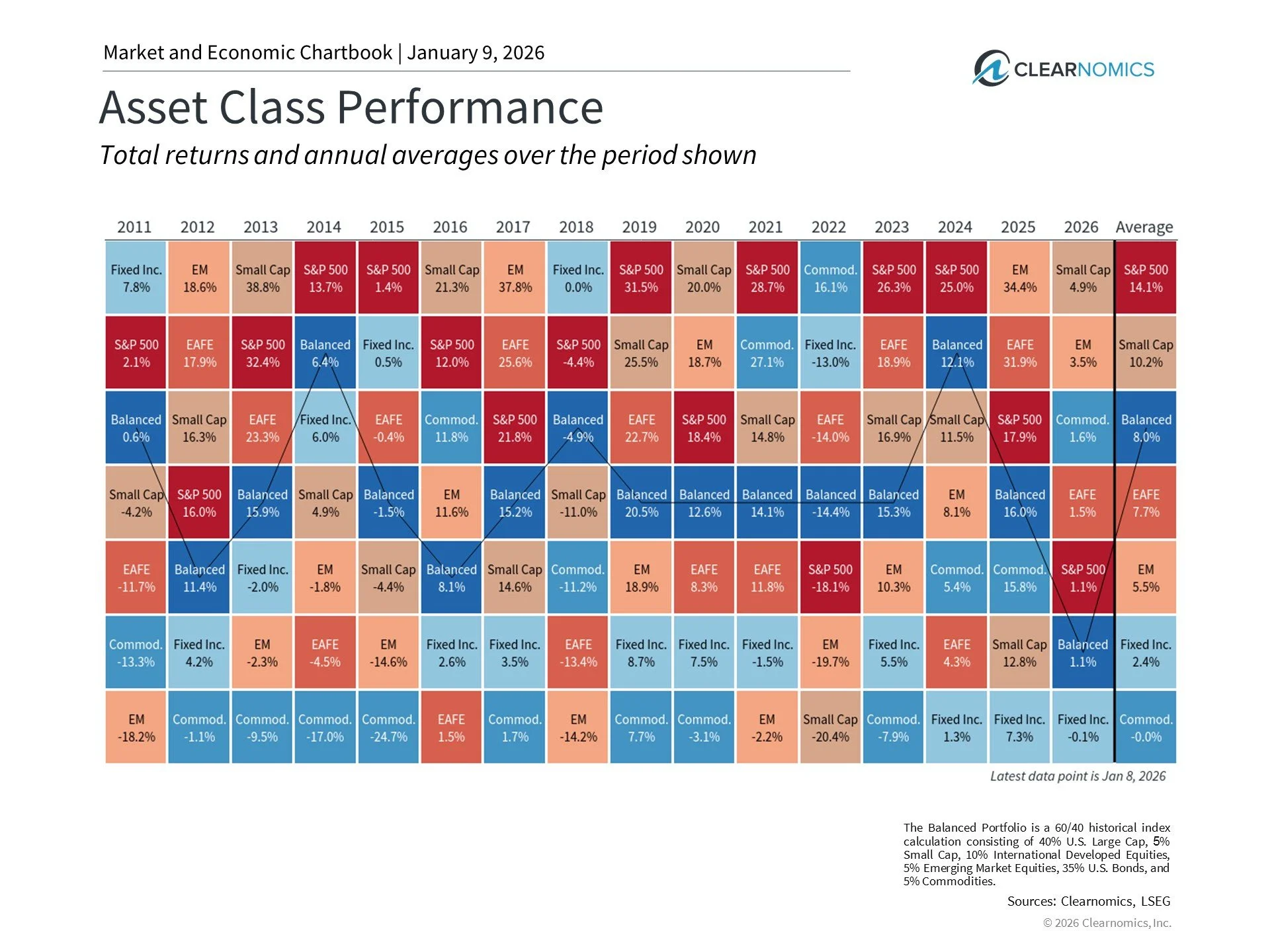

2025 was historically strong for financial markets despite significant events including April's tariff announcements, developments in artificial intelligence, and fiscal policy changes. The S&P 500 has now delivered double-digit returns in six of the past seven years, demonstrating the resilience of long-term investing. Here are some key highlights from 2025:

• U.S. stocks performed exceptionally well, with the S&P 500 gaining 17.9%, the Dow rising 14.9%, and the Nasdaq returning 21.2%. The S&P 500 reached 39 new all-time highs during the year, while the VIX measure of volatility remained relatively low at 14.95 by year-end despite spiking to 52.33 in April.

• International markets outperformed U.S. stocks in 2025, with developed markets and emerging markets each gaining over 30% in dollar terms. The U.S. dollar weakened by 9.3% during the year, which benefited international investments for U.S. investors.

• Bonds rebounded strongly with the Bloomberg U.S. Aggregate Bond Index gaining 7.3%, its best performance since 2020, as the 10-year Treasury yield declined from 4.57% to 4.17%. Gold and silver also had exceptional years, with gold rising 64% to $4,341 per ounce.

These results remind us that staying invested and maintaining a long-term perspective helps investors capture gains even during periods of uncertainty and volatility.

Taken together, 2025 was a reminder that the economy and the markets don’t move in lockstep—and that headlines rarely tell the full story. A cooling job market can feel unsettling, even while markets continue to reward long-term discipline and diversified investing. This is exactly why a clear plan matters more than reacting to the news cycle: when you understand your strategy, your goals, and your timeline, short-term uncertainty becomes background noise instead of a call to panic. Smart money decisions aren’t about predicting what comes next—they’re about being prepared for whatever does.